Table Of Content

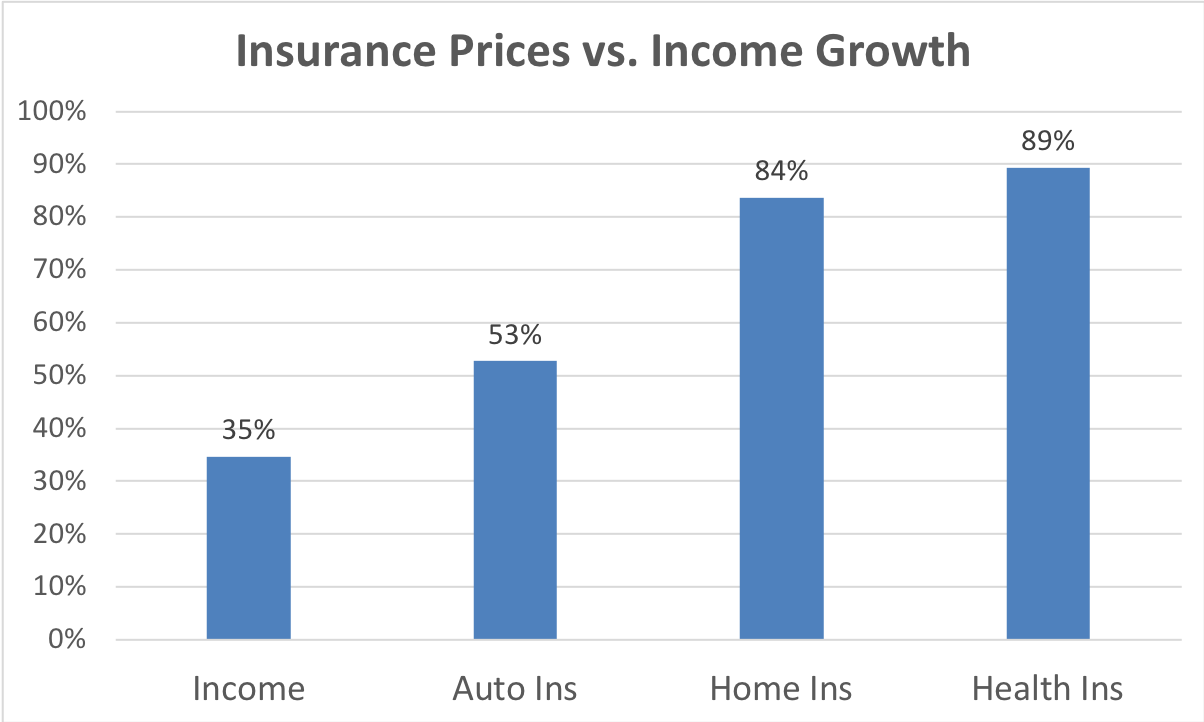

Home insurance prices are roughly 35% higher nationally compared to two years ago, with several wildfire and tornado-prone states accounting for the largest average increases. Nationwide home insurance features a slew of comprehensive coverage options. AM Best is a global credit rating agency that scores the financial strength of insurance companies on a scale from A++ (Superior) to D (Poor). Review your policy limits each year to make sure you have enough coverage. Read our guide on how much home insurance you need for more information. Use the homeowners insurance calculator below to get an average in your ZIP code, or follow the steps to estimate for yourself.

Average home insurance costs by coverage level

But it’s important to understand how each coverage is calculated and opt for higher limits if your situation calls for it. An umbrella insurance policy kicks in when you exhaust your home insurance liability coverage limits. An umbrella policy will also extend over your auto insurance policy, providing extra liability insurance in case you cause a large car accident. When hearing that location can influence home insurance costs, many people’s minds jump to state-by-state cost considerations.

Cheapest home insurance companies in California

But there are several actions you can take to reduce your rates and ensure you're not paying more than you should be for homeowners insurance. Homeowners insurance on a $500,000 house costs an average of $2,724 per year. But this cost can vary widely from $1,198 to $6,238 per year depending on where you live and other circumstances. Homeowners insurance on a $400,000 house costs an average of $2,222 per year. But this cost can vary widely from $999 to $5,064 per year depending on where you live and other circumstances.

Highest homeowners insurance rates by ZIP code

Home insurance policies typically provide liability coverage starting at $100,000 but that might not be enough. The liability insurance within a homeowners policy pays for injuries and property damage you accidentally cause others. For example, if your dog bites someone, your liability insurance can cover the medical expenses.

One quick, if not imperfect, way to estimate your home insurance coverage is by multiplying the square footage of your home by the average building cost per-square-foot in your area. To find out the cost to rebuild in your area, contact a few contractors in your area, get a quote, and then take the average of each one. You should have enough personal property coverage to cover the value of all of your personal belongings, including your clothes, furniture, electronics, and jewelry. The best way to find out how much personal property coverage you need is by taking an inventory of your personal belongings. Our 2022 Policygenius Home Insurance Pricing Report found that home insurance premiums increased an average of 12% from May 2021 to May 2022 — faster than the record-breaking rate of inflation during that span.

Homeowners insurance is so expensive right now because home insurance companies have been experiencing costly claims due to inflation and supply-chain shortages skyrocketing the price to repair or rebuild homes. Your homeowners insurance cost can also depend on the homeowners insurance coverages and homeowners insurance deductibles you select. You may be able to increase your coverage by thousands and your insurance rate might only be minimally impacted.

After adjusting for inflation, damage from billion-dollar disasters from the past three years averages out to $149.2 billion per year. In most states, your credit history could be used as an insurance rating factor. Depending on where you live, home insurance companies will generally review your credit history when you apply for a quote.

What are the best home insurance companies?

You may want to try bundling your home and auto insurance for a discount and possibly get better prices on both policies. The national average cost of homeowners insurance is $1,582 per year, according to our analysis. That home insurance estimate is for a policy with $350,000 in dwelling coverage, $175,000 for personal property coverage and $100,000 in liability coverage. On average, Nationwide is one of the cheapest homeowners insurance companies on our list, which helped it earn Bankrate's Best Budget Home Insurance Company award for 2024. The company offers add-ons like Better Roof Replacement, which will replace your roof with higher-quality materials in the event of a covered claim. Homeowners who prefer to manage their home insurance policy and financial products with one company may find Nationwide appealing, as well.

There are hundreds of home insurance companies on the market, which may make it confusing to know where to start. Bankrate is aware that most homeowners would appreciate an estimate of how much they can expect to spend on a policy first. In the United States, the average cost of homeowners insurance is $2,151 per year for $300,000 in dwelling coverage. This can help you gauge what other Americans budget for their home insurance, but your rate is likely to be different. Generally, HO-3 and HO-5 homeowners insurance policies will cover your home and personal belongings against most types of damage or losses. However, there are several common disasters and liability-related expenses that are not covered by any home insurance policy unless you purchase additional coverage.

4 Best Homeowners Insurance Companies in Pensacola (2024) - MarketWatch

4 Best Homeowners Insurance Companies in Pensacola ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

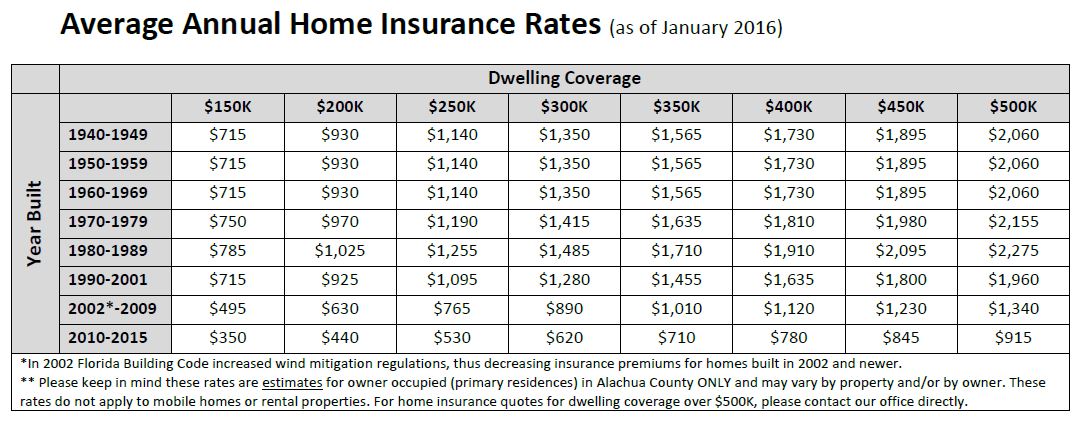

Older homes might be more expensive to build back after a loss, especially if you need to bring them up to modern safety and building codes. Below is a look at how much an average home insurance policy might cost depending on the age of a home. Your deductible is another factor that can impact the cost of your home insurance. When you set a high deductible, you take on some of the risk that would otherwise be transferred to your homeowners insurance company. Dwelling insurance — also known as coverage A — is the limit your insurance company will pay to repair or rebuild your home when damaged by a covered peril.

It’s no surprise that many of the most expensive ZIP codes for homeowners insurance are in states that experience a lot of severe weather. The most expensive ZIP codes in Texas, Louisiana, Alabama, the Carolinas, and, of course, Florida all have coastal areas prone to catastrophic storms that are costly to insurers, who then pass that cost on to homeowners. Texas, Kansas, Oklahoma, Florida, Alabama, and Mississippi also have a lot of tornadoes. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

California state laws (Proposition 103, in particular) prohibit insurers from raising rates more than 7 percent without approval from the state’s Department of Insurance. As you can imagine, this clogs up the process and results in home insurance rates getting stuck at unsustainably low levels. In order to find the best cheap home insurance in California, we started by reviewing the most up-to-date rates available. From there, we narrowed the search to include rates from the larger insurers in the state by market share. Given the volatility of the California home insurance market, we ensured that each provider on our list is still writing policies in the state.

Your exact price will depend on specific personal details, such as the location and age of your house and the coverage limits you choose. However, our analysis can give you an idea of what you might expect to pay. Here is a breakdown of the average annual home insurance cost by dwelling coverage amount, which should match the amount it would cost to rebuild your house. The higher your rebuilding costs, the more you will pay for homeowners insurance.

Homes that are larger, have outdated electrical or plumbing, or are constructed with obsolete materials will likely see higher rates since they’re either pricier to rebuild or because they face an increased risk of damage. Homes with pools, trampolines, or even dogs will also see higher home insurance rates due to the increased risk of an injury on the premises. This covers damage to property not attached to your house, such as a shed or gazebo. The coverage amount usually is 10% of your dwelling coverage limit but you can increase it. While your house and belongings are two of the main items protected by homeowners coverage, there is much more to what a home insurance policy covers. One of the best and easiest ways to find the cheapest home insurance is by comparing quotes from multiple companies.

Additionally, State Farm’s average premium for homeowners insurance is on par with the national average. Bankrate's insurance editorial team, which includes licensed agents, has compiled information worth considering when shopping for home insurance quotes. Our industry expertise, combined with our analysis of average rate data from Quadrant Information Services, might help you understand the process of comparing home insurance quotes. Our goal is to streamline your shopping to help you find the best coverage for your needs. Insurance companies input these details in their valuation tools to calculate the home’s replacement cost. Since each company has its own proprietary rating algorithm, the calculated amount can vary by insurer, but it is the amount the insurer will base the dwelling coverage amount on.

Nationwide may not be ideal for you, though, if you’re more concerned with customer service than price. It scored lower-than-average in a study of customer satisfaction, according to J.D. In the table below, we’ve compiled average premiums from analytics company Quadrant Information Services for some of the most common dwelling coverage limits available for standard home insurance policies. However, the overall cost of your homeowners policy depends on much more than just your dwelling coverage. To perform a homeowners insurance costs calculation, you will need to gather information about your home and belongings. This information will help you estimate your rebuild cost and the approximate value of your personal property.

No comments:

Post a Comment